Popular Candlestick Patterns

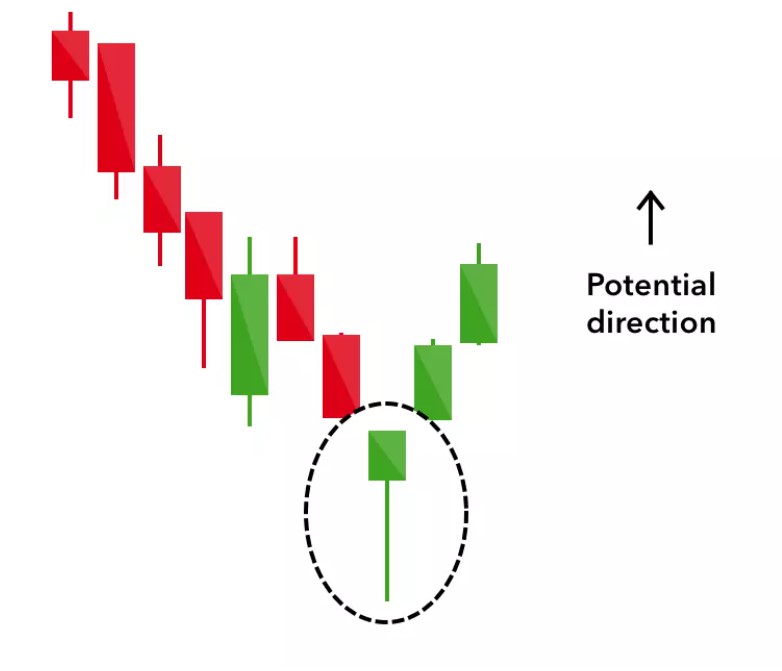

Hammer

The Hammer pattern is a bullish reversal pattern that occurs after a downtrend, indicating potential price reversal.

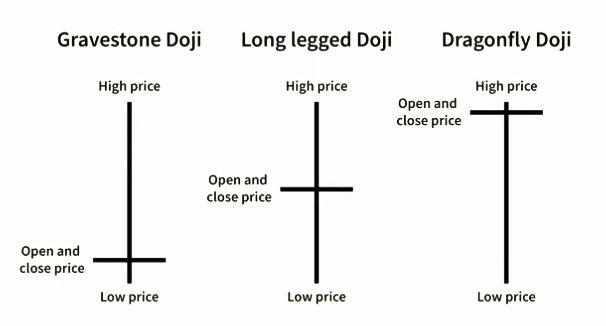

Doji

The Doji candlestick indicates indecision in the market, signaling potential trend reversal or continuation.

Bullish Engulfing

The Bullish Engulfing pattern signals a potential bullish reversal after a downtrend.

Hanging Man

The Hanging Man is a bearish reversal pattern that occurs after an uptrend, indicating potential selling pressure.

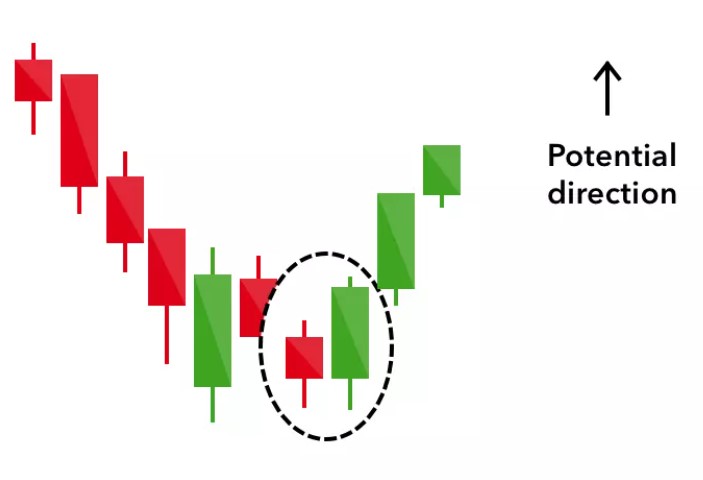

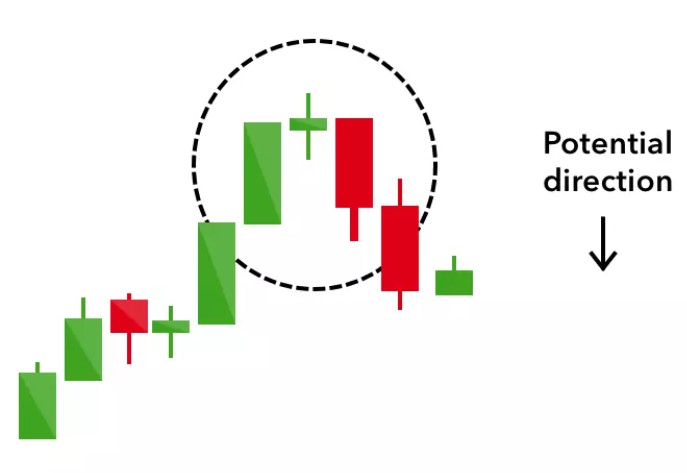

Morning Star

The Morning Star is a bullish reversal pattern consisting of three candlesticks that appear at the bottom of a downtrend.

Shooting Star

The Shooting Star is a bearish reversal pattern that occurs after an uptrend, indicating potential downward price action.

Bearish Engulfing

The Bearish Engulfing pattern signals a potential bearish reversal after an uptrend.

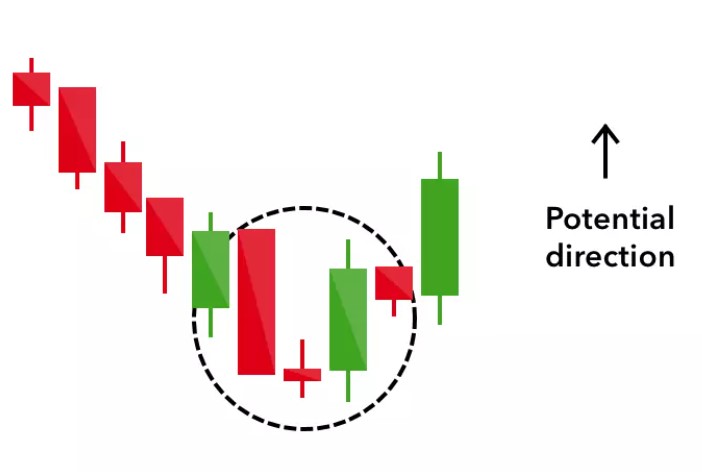

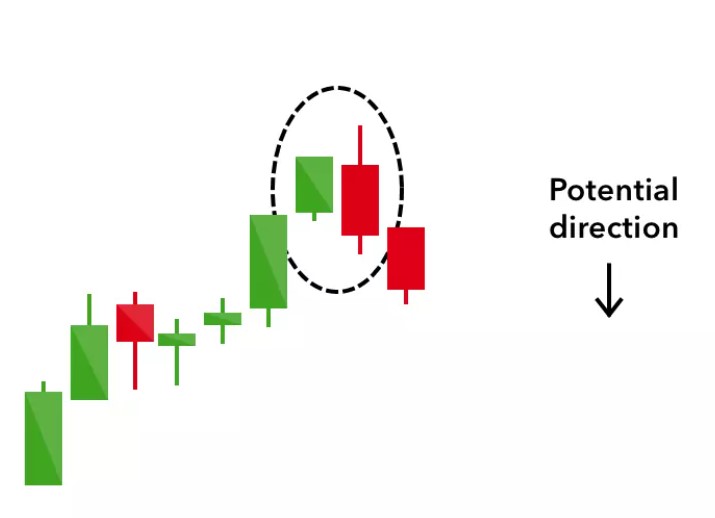

Evening Star

The Evening Star is a bearish reversal pattern consisting of three candlesticks that appear at the top of an uptrend.

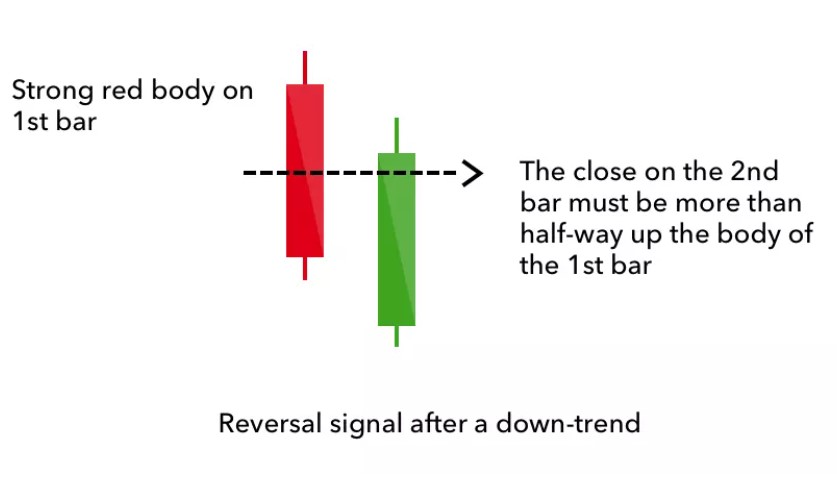

Piercing Pattern

The Piercing Pattern is a bullish reversal pattern that occurs after a downtrend, indicating potential upward movement.

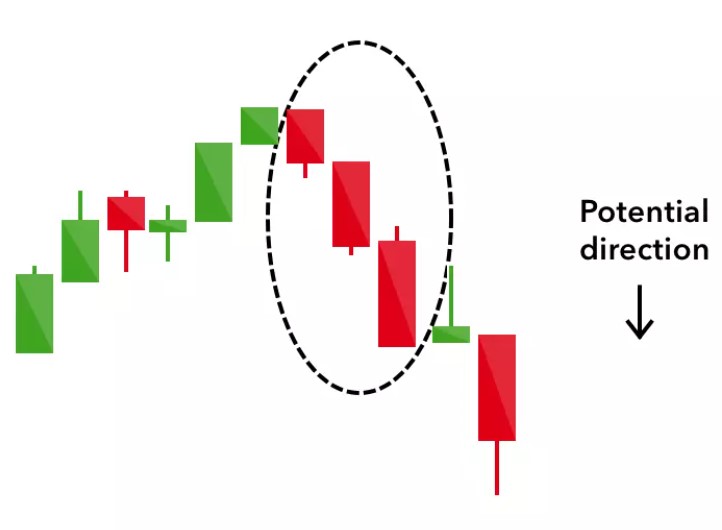

Three Black Crows

The Three Black Crows pattern is a bearish reversal pattern that occurs after an uptrend, signaling a potential shift to the downside.

For more candlesticks chart patterns visit this link.